FAQs on IFRS

“Frequently Asked Questions on IFRS”

BLOG

FREQUENTLY ASKED QUESTIONS ON IFRS

What are Accounting Standards?

Accounting Standards are the policy documents issued by the relevant Statutory Authority / Apex Accountancy body for recognition, measurement, presentation and disclosure of the events and business transactions having economic consequences on an enterprise.

What is the mission of IFRS Foundation?

- bring transparency by enhancing the international comparability and quality of financial information, enabling investors and other market participants to make informed economic decisions.

- strengthen accountability by reducing the information gap between the providers of capital and the people to whom they have entrusted their money.

- contribute to economic efficiency by helping investors to identify opportunities and risks across the world, thus improving capital allocation.

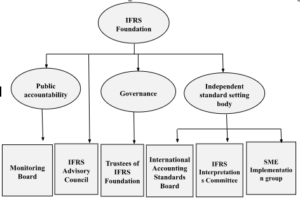

The IFRS Foundation has three tier governance structure which covers the following:

What is Advisory Council?

The Advisory Council is the formal advisory body to the Trustees of the IFRS Foundation and the International Accounting Standards Board (Board). It consists of a wide range of representatives comprising individuals and organisations with an interest in international financial reporting.

What is IASB?

The International Accounts Standards Board is an independent group of experts with an appropriate mix of recent practical experience in setting accounting standards, in preparing, auditing, or using financial reports, and in accounting education. Board members are responsible for the development and publication of IFRS Standards, including the IFRS for SMEs Standard. The Board is also responsible for approving Interpretations of IFRS Standards as developed by the IFRS Interpretations Committee (formerly IFRIC).

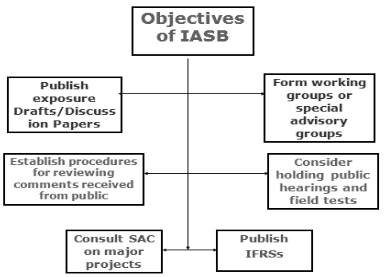

Objectives of International Accounting Standards Board are enumerated in the chart as under:

How does IASB operate?

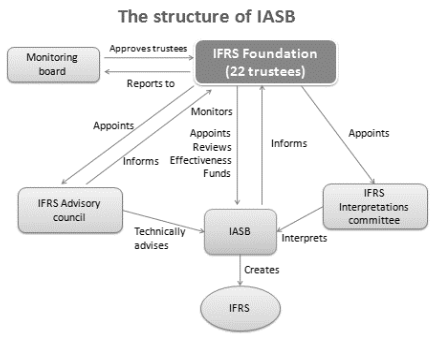

The IASB operates through the functional identities shown the chart below.

What is IFRS Interpretations Committee?

|

The IFRS Interpretations is the interpretative body of the International Accounting Standards Board (Board). The Interpretations Committee works with the Board in supporting the application of IFRS Standards |

What are International Financial Reporting Standards (IFRSs)?

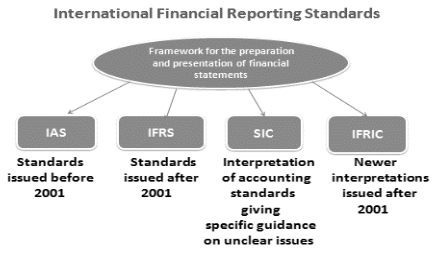

International Financial Reporting Standards (IFRSs) are standards and their interpretations issued by the International Accounting Standards Board (IASB) and its predecessor body, viz., International Accounting Standards Committee (IASC). They comprise:

- International Financial Reporting Standards.

- International Accounting Standards, and

- Interpretations by the International Financial Reporting Interpretations Committee (IFRIC) or the former Standing Interpretations Committee (SIC).

This is explained in the chart below.

What is called Conceptual Framework?

The Framework is the conceptual framework upon which the IASs are based and hence which determines how financial statements are prepared and the information they contain.

What is going concern assumption?

|

The financial statements are normally prepared on the assumption that an enterprise is a going concern and will continue in operation for the foreseeable future. Going concern concept indicates that assets are kept for generating benefit in future, not for immediate sale, current change in the asset value is not realizable and so it should not be counted. |

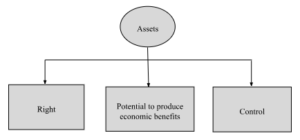

How is Asset defined under Framework?

An asset is a present economic resource controlled by the entity as a result of past events. An economic resource is a right that has the potential to produce economic benefits.

The above definition stresses on three elements as shown below:

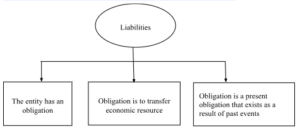

How is liability defined under Framework?

A liability is a present obligation of the entity to transfer an economic resource as a result of past events.

The above definition stresses on three elements as shown below:

How is equity defined under Framework?

|

The residual interest in the assets of the enterprise after deducting all its liabilities. |

How is income defined under Framework?

Income is increases in assets, or decreases in liabilities, that result in increases in equity, other than those relating to contributions from holders of equity claims.

How are expenses defined under Framework?

|

Expenses are decreases in assets, or increases in liabilities, that result in decreases in equity, other than those relating to distributions to holders of equity claims. |

What is the recognition criteria according to Framework?

|

What is the recognition criteria according to Framework? An asset or liability is recognised only if recognition of that asset or liability and of any resulting income, expenses or changes in equity provides users of financial statements with information that is useful, i.e. with: (a) relevant information about the asset or liability and about any resulting income, expenses, or changes in equity; and (b) a faithful representation of the asset or liability and of any resulting income, expenses, or changes in equity. |

What is fair value according to Framework?

According to Framework, fair value is the price that would be received to sell an asset, or paid to transfer a liability, in an orderly transaction between market participants at the measurement date.

What is value in use and fulfilment value according to Framework?

Value in use is the present value of the cash flows or other economic benefits, that an entity expects to derive from the use of an asset and from its ultimate disposal. Fulfillment value is the present value of the cash or other economic resources, that an entity expects to be obliged to transfer as it fulfills a liability.

What is current cost according to Framework?

The current cost of an asset is the cost of an equivalent asset at the measurement date, comprising the consideration that would be paid at the measurement date plus the transaction costs that would be incurred at that date.

How does current cost differ from Fair value, value in use and fulfilment value?

Current cost, like historical cost, is an entry value, it reflects prices in the market in which the entity would acquire the asset or would incur the liability. whereas fair value, value in use and fulfilment value, which are exit values.

How do we measure equity under Framework?

Pursuant to the Framework, the total carrying amount of equity (total equity) is not measured directly. It equals the total of the carrying amounts of all recognised assets less the total of the carrying amounts of all recognised liabilities. But the Framework makes it clear that, because general purpose financial statements are not designed to show an entity’s value, the total carrying amount of equity will not generally equal:

(a) the aggregate market value of equity claims on the entity,

(b) the amount that could be raised by selling the entity as a whole on a going concern basis; or

(c) the amount that could be raised by selling all of the entity’s assets and settling all of its liabilities.

What are the components of Financial Statements?

∙ A statement of financial position at the end of the period

∙ A statement of Profit & Loss and Other Comprehensive Income for the period

∙ A statement of changes in equity for the period

∙ A statement of cash flows for the period

∙ Notes comprising of accounting policies and other explanatory notes, reports that are outside financial statements – are outside scope of IFRS (IAS 1.4)

What are the information elements the Financial Statements needs to provide?

|

Financial statements must provide information about following aspects: ∙ Assets ∙ Liabilities ∙ Equity ∙ Income & Expenses (including gains and losses) ∙ Contributions by and contributions to owners in their capacity as owners ∙ Cash flows |

What does Statement of Financial Position include?

The Statement of Financial Position depicts the short-term and long-term solvency of the organization and depicts the following:

∙ Assets

∙ Liabilities and

∙ Equity of the organization.

The statement of financial position shall include line items that present the following amounts:

(a) property, plant, and equipment;

(b) investment property;

(c) intangible assets;

(d) financial assets (excluding amounts shown under (e), (h), and (i));

(da) groups of contracts within the scope of IFRS 17 that are assets, disaggregated as required by paragraph 78 of IFRS 17;

(e) investments accounted for using the equity method.

(f) biological assets within the scope of IAS 41 Agriculture;

(g) inventories.

(h) trade and other receivables;

(i) cash and cash equivalents;

(j) the total of assets classified as held for sale and assets included in disposal groups classified as held for sale in accordance with IFRS 5 Non‑current Assets Held for Sale and Discontinued Operations.

(k) trade and other payables.

(l) provisions.

(m) financial liabilities (excluding amounts shown under (k) and (l));

(ma) groups of contracts within the scope of IFRS 17 that are liabilities, disaggregated as required by paragraph 78 of IFRS 17;

(n) liabilities and assets for current tax, as defined in IAS 12 Income Taxes.

(o) deferred tax liabilities and deferred tax assets, as defined in IAS 12;

(p) liabilities included in disposal groups classified as held for sale in accordance with IFRS 5;

(q) non‑controlling interests, presented within equity; and

(r) issued capital and reserves attributable to owners of the parent.

What does statement of profit & loss include?

The statement of Profit & Loss depicts the net financial results of the organization represented by income and expenses and would include all items of income and expense in a period in profit or loss unless an IFRS requires or permits otherwise.

Information to be presented in the statement of profit and loss or in the notes

i) When items of income or expense are material, an entity shall disclose their nature and amount separately.

ii) Circumstances that would give rise to the separate disclosure of items of income and expense include:

(a) Write-downs of inventories to net realisable value or of property, plant and equipment to recoverable amount, as well as reversals of such write-downs;

(b) restructurings of the activities of an entity and reversals of any provisions for the costs of restructuring,

(c) disposals of items of property, plant and equipment,

(d) disposals of investments,

(e) discontinued operations,

(f) litigation settlements; and

(g) other reversals of provisions.

iii) An entity shall present an analysis of expenses recognised in profit or loss using a classification based on function or the nature of expense method.

An example of a classification using the function method is as under:

|

Revenue X Cost of sales (X) Gross Profit X Other income X Distribution costs X Administration costs X Other expenses X Finance cost X X Share of profit from Associates X Profit before tax X |

An example of a classification using the nature of expense method is as follows:

|

Revenue X Other income X Changes in inventories of finished goods & work in progress X Raw materials and consumables used X Employee benefits expense X Depreciation and amortization expense X Other expenses X Total expenses (X) Profit before tax X |

What does statement of other comprehensive income include?

The Statement of other comprehensive income would include amounts of other comprehensive income in the period, classified by nature (including share of the other comprehensive income of associates and joint ventures accounted for using the equity method) and grouped into those that, in accordance with other IFRSs

(a) will not be reclassified subsequently to profit or loss; and

(b) will be reclassified subsequently to profit or loss when specific conditions are met.

The components of other comprehensive income include:

(a) changes in revaluation surplus (IAS 16 Property, Plant and Equipment. IAS 38 Intangible Assets and IAS 40 Investment properties);

(b) remeasurements of defined benefit plans (IAS 19 Employee Benefits);

(c) gains and losses arising from translating the financial statements of a foreign operation (see IAS 21 The Effects of Changes in Foreign Exchange Rates);

(d) gains and losses from investments in equity instruments designated at fair value through other comprehensive income in accordance with paragraph 5.7.5 of IFRS 9 Financial Instruments.

(da) gains and losses on financial assets measured at fair value through other comprehensive income in accordance with paragraph 4.1.2A of IFRS 9.

(e) the effective portion of gains and losses on hedging instruments in a cash flow hedge and the gains and losses on hedging instruments that hedge investments in equity instruments measured at fair value through other comprehensive income in accordance with paragraph 5.7.5 of IFRS 9 (Chapter 6 of IFRS 9);

(f) for particular liabilities designated as at fair value through profit or loss, the amount of the change in fair value that is attributable to changes in the liability’s credit risk (paragraph 5.7.7 of IFRS 9);

(g) changes in the value of the time value of options when separating the intrinsic value and time value of an option contract and designating as the hedging instrument only the changes in the intrinsic value (Chapter 6 of IFRS 9);

(h) changes in the value of the forward elements of forward contracts when separating the forward element and spot element of a forward contract and designating as the hedging instrument only the changes in the spot element, and changes in the value of the foreign currency basis spread of a financial instrument when excluding it from the designation of that financial instrument as the hedging instrument (Chapter 6 of IFRS 9);

(i) insurance finance income and expenses from contracts issued within the scope of IFRS 17-Insurance Contracts excluded from profit or loss when total insurance finance income or expenses is disaggregated to include in profit or loss an amount determined by a systematic allocation applying paragraph 88(b) of IFRS 17, or by an amount that eliminates accounting mismatches with the finance income or expenses arising on the underlying items, applying paragraph 89(b) of IFRS 17; and

(j) finance income and expenses from reinsurance contracts held excluded from profit or loss when total reinsurance finance income or expenses is disaggregated to include in profit or loss an amount determined by a systematic allocation applying paragraph 88(b) of IFRS 17.

What does Statement of Equity include?

(i) An entity shall present a statement of changes in equity as a part of Statement of Financial Position as required by the IFRS. The statement of changes in equity includes the following information:

(a) total comprehensive income for the period, showing separately the total amounts attributable to owners of the parent and to non-controlling interests.

(b) for each component of equity, the effects of retrospective application or retrospective restatement recognised in accordance with IAS 8;

(d) for each component of equity, a reconciliation between the carrying amount at the beginning and the end of the period, separately disclosing each changes resulting from:

(i) profit or loss;

(ii) other comprehensive income.

(iii) transactions with owners in their capacity as owners, showing separately contributions by and distributions to owners and changes in ownership interests in subsidiaries that do not result in a loss of control.

Information to be presented in the statement of changes in equity which is a part of the Statement of Financial Position or in the notes

(ii) For each component of equity an entity shall present, either in the statement of changes in equity or in the notes, an analysis of other comprehensive income by item.

(iii) An entity shall present, either in the statement of changes in equity or in the notes, the amount of dividends recognised as distributions to owners during the period, and the related amount of dividends per share.

What is statement of Cash Flows?

Provides users of financial statements with a basis to assess the ability of the entity to generate cash and cash equivalents and the needs of the entity to utilize those cash flows.

What do Notes to Accounts provide?

|

∙ Present information about basis of preparation of financial statements and specific accounting policies used ∙ disclose any information required by IFRSs not presented elsewhere in the financial statements and ∙ provide additional information that is relevant for understanding of the financial statements not presented elsewhere in the financial statements |

What is meant by fair presentation?

|

The financial statements must present “fairly” the financial position, financial performance, and cash flows of an entity. Fair presentation requires faithful representation of – the effects of transactions – other events and conditions in accordance with the definitions and recognition criteria for assets, liabilities income and expenses set out in the framework. The application of IFRSs with additional disclosure when necessary, is presumed to result in financial statements that achieve a fair presentation. (Paragraph 15 of IAS 1) A fair presentation requires an entity: (a) to select and apply accounting policies in accordance with IAS 8 Accounting Policies, Changes in Accounting Estimates and Errors. IAS 8 sets out a hierarchy of authoritative guidance that management considers in the absence of an IFRS that specifically applies to an item. (b) to present information, including accounting policies, in a manner that provides relevant, reliable, comparable, and understandable information. (c) to provide additional disclosures when compliance with the specific requirements in IFRSs is insufficient to enable users to understand the impact of particular transactions, other events and conditions on the entity’s financial position and financial performance. (Paragraph 17 of IAS 1) |

What is meant by effective compliance of IFRS?

IAS 1 requires that an entity whose financial statements comply with IFRSs make an explicit and unreserved statement of such compliance in the notes. Financial statements shall not be described as IFRS compliant unless they comply with all the requirements of IFRSs (including interpretations) (Paragraph 16)

All relevant IFRS must be followed if compliance with IFRS is disclosed.

An entity cannot rectify inappropriate accounting policies either by disclosure of the accounting policies used or by notes or explanatory material. (Paragraph 18)

What does departure from compliance with IFRS signify?

According to IAS 1, if in extremely rare circumstances, the Management concludes that IFRS compliance would be so misleading as to conflict the objective of the financial statements – it needs to provide detailed disclosure of the nature, reasons, and impact of such departure (Paragraph 19).

According to Paragraph 20, When an entity departs from a requirement of an IFRS in accordance with paragraph 19, it shall disclose:

(a) that management has concluded that the financial statements present fairly the entity’s financial position, financial performance and cash flows.

(b) that it has complied with applicable IFRSs, except that it has departed from a particular requirement to achieve a fair presentation.

(c) the title of the IFRS from which the entity has departed, the nature of the departure, including the treatment that the IFRS would require, the reason why that treatment would be so misleading in the circumstances that it would conflict with the objective of financial statements set out in the Conceptual Framework, and the treatment adopted; and

(d) for each period presented, the financial effect of the departure on each item in the financial statements that would have been reported in complying with the requirement.

When an entity has departed from a requirement of an IFRS in a prior period, and that departure affects the amounts recognised in the financial statements for the current period, it shall make the disclosures set out in (c) and (d) above. (Paragraph 21).

What is meant by Going Concern assessment?

In accordance with IAS 1, an entity shall prepare financial statements under IFRS on a going concern basis unless Management has significant concerns about the entity’s ability to continue as going concern. Accordingly, management shall make an assessment of an entity’s ability to continue as a going concern. When management is aware, in making its assessment, of material uncertainties related to events or conditions that may cast significant doubt upon the entity’s ability to continue as a going concern, the entity shall disclose those uncertainties. IAS I requires a series of disclosures to that effect (Paragraph 25)

Going concern assessment is critical and would in general delve through the following parameters:

a) History of profitable operations

b) Current and expected profitability

c) Access to productive financial resources

d) Debt repayment schedules and potential sources of replacement funding based on projected cash flows generated out of the business

If based on the above parameters, the entity fails to pass the test of a going concern then additional disclosures are necessary explaining the basis on which the financial statements have been prepared and the reasons why the entity is not considered a going concern.

What is accrual accounting?

According to IAS 1, an entity shall prepare its financial statements, except for cash flow information, using the accrual basis of accounting. (Paragraph 27)

When the accrual basis of accounting is used, an entity recognizes items as assets, liabilities, equity, income, and expenses (the elements of financial statements) when they satisfy the definitions and recognition criteria for those elements in the Conceptual Framework. (Paragraph 28)

What is materiality and aggregation?

An entity shall present separately each material class of similar items. An entity shall present separately items of a dissimilar nature or function unless they are immaterial. (Paragraph 29 of IAS 1).

Information is material if omitting, misstating or obscuring it could reasonably be expected to influence decisions that the primary users of general purpose financial statements make on the basis of those financial statements, which provide financial information about a specific reporting entity.

Examples of circumstances that may result in material information being obscured are shown as under:

(a) information regarding a material item, transaction or other event is disclosed in the financial statements but the language used is vague or unclear;

(b) information regarding a material item, transaction or other event is scattered throughout the financial statements;

(c) dissimilar items, transactions or other events are inappropriately aggregated;

(d) similar items, transactions or other events are inappropriately disaggregated; and

(e) the understandability of the financial statements is reduced as a result of material information being hidden by immaterial information to the extent that a primary user is unable to determine what information is material.

What is meant by offsetting?

An entity shall not offset assets and liabilities or income and expenses, unless required or permitted by an IFRS. (Paragraph 32 of IAS 1).

What does consistency of presentation signify?

An entity shall retain the presentation and classification of items in the financial statements from one period to the next unless:

(a) it is apparent, following a significant change in the nature of the entity’s operations or a review of its financial statements, that another presentation or classification would be more appropriate having regard to the criteria for the selection and application of accounting policies in IAS 8; or

(b) an IFRS requires a change in presentation (Paragraph 45 of IAS 1).

What is Operating Cycle?

An operating cycle is the time between the acquisition of assets for processing and their realization in cash or cash equivalents. Where the normal operating cycle cannot be identified. It is assumed to have a duration of 12 months.

What does current / non-current distinction signify?

In accordance with paragraph 60 and 61 of IAS 1, an entity shall present current and non‑current assets, and current and non‑current liabilities, as separate classifications in its statement of financial position in accordance with paragraphs 66–76 of this Standard except when a presentation based on liquidity provides information that is reliable and more relevant. When that exception applies, an entity shall present all assets and liabilities in order of liquidity.

Whichever method of presentation is adopted, an entity shall disclose the amount expected to be recovered or settled after more than twelve months for each asset and liability line item that combines amounts expected to be recovered or settled:

(a) no more than twelve months after the reporting period, and

(b) more than twelve months after the reporting period.

When does an entity classify its assets as current assets?

|

An asset should be classified as a current asset when it: (a) it expects to realize the asset, or intends to sell or consume it, in its normal operating cycle, (b) it holds the asset primarily for the purpose of trading, (c) it expects to realize the asset within twelve months after the reporting period; or (d) the asset is cash or a cash equivalent (as defined in IAS 7) unless the asset is restricted from being exchanged or used to settle a liability for at least twelve months after the reporting period. An entity shall classify all other assets as non‑current. (Paragraph 66 of IAS 1) Note: Operating cycle of an entity is the time between acquisition of assets for processing and their realization in cash or cash equivalents |

When does an entity classify its liabilities as current liabilities?

An entity shall classify a liability as current when:

(a) it expects to settle the liability in its normal operating cycle;

(b) it holds the liability primarily for the purpose of trading;

(c) the liability is due to be settled within twelve months after the reporting period; or

(d) it does not have an unconditional right to defer settlement of the liability for at least twelve months after the reporting period (see paragraph 73 of IAS 1). Terms of a liability that could, at the option of the counterparty, result in its settlement by the issue of equity instruments do not affect its classification.

An entity shall classify all other liabilities as non‑current. (Paragraph 69 of IAS 1).

What are the broad sub-classification disclosures of assets?

|

• Property, Plant and Equipment are disaggregated by class as described in IAS 16 Property, Plant and Equipment • Receivables are disaggregated between amounts receivables from trade customers, other members of the group, receivables from related parties, prepayments and other amounts • Inventories are disaggregated as per IAS 2 Inventories into merchandise, production supplies, materials, work in progress and finished goods |

What are the broad sub-classification disclosures of share capital and reserves?

|

For each class of share capital: • Number of shares authorized • Number of shares issued and fully paid, and issued but not fully paid • Par value per share or that the shares have no par value • Reconciliation of number of shares outstanding at the beginning and at the end of the year • Rights, preferences, and restrictions attaching to that class including restrictions on the distribution of dividends and the repayment of capital • Shares in the entity held by the entity itself or by related group companies • Shares reserved for issuance under options and sales contracts, including terms and amounts • Description of the nature and purpose of each reserve within owners’ equity |

What is the sub-classification of Financial Instruments?

If an entity has reclassified

(a) a puttable financial instrument classified as an equity instrument, or

(b) an instrument that imposes on the entity an obligation to deliver to another party a pro rata share of the net assets of the entity only on liquidation and is classified as an equity instrument between financial liabilities and equity, it shall disclose the amount reclassified into and out of each category (financial liabilities or equity), and the timing and reason for that reclassification. (Paragraph 80A of IAS 1)

How are inventories defined under IFRS?

Inventories are assets that are:

- held for sale in the ordinary course of business

- in the process of production for such sale

- in the form of material or supplies to be consumed in the production process or

- in the rendering of services in case of service providers

● inventories include the cost of services for which the related revenue has not yet been recognized (work in progress for lawyers, auditors, architects, etc

How are inventories recognized?

Inventories are recognized at lower cost and Net realizable value (NRV)

What is Net Realisable Value?

|

Net realizable value is the estimated selling price in the ordinary course of business less estimated cost of completion to make the sale. NRV is likely to be less than the cost in the following cases: – an increase in costs or a fall in the selling price – a physical deterioration in the condition of the inventory – Obsolescence of products – Marketing strategy to sell products at a loss – Errors in production or purchasing Inventories are usually written down to NRV on the following principles: – items are treated on an item-by-item basis – similar items are normally grouped together – each service is treated as a separate item |

What are the bases of valuation of inventories?

|

FIFO (First in first out) Weighted Average cost Specific identification of costs (in other cases) |

What are the techniques used for measurement of inventories?

|

The techniques used to measure inventories are: Standard cost Retail method |

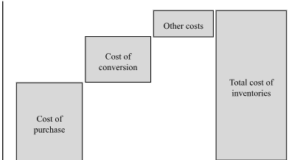

How are inventories measured at cost?

Inventory measurement at cost would include:

costs of purchase,

costs of conversion and

other costs incurred in bringing the inventories to their present location and condition.

Waterfall chart below shows the accumulation of cost of inventories

What are the elements included in cost of purchase of inventories?

|

Cost of purchase of inventories would include the following: The purchase price import duties and other taxes (other than those subsequently recoverable by the entity from the taxing authorities), Transport, handling, and other costs directly attributable to the acquisition of finished goods, materials, and services. Trade discounts, rebates and other similar items are deducted in determining the costs of purchase |

What are the elements included in cost of conversion of inventories?

Cost of conversion of inventories would include the following:

Costs directly related to the units of production, such as direct labour.

They also include a systematic allocation of fixed and variable production overheads that are incurred in converting materials into finished goods.

What are the elements included in other cost of inventories?

|

The other cost of inventories only to the extent that they are incurred in bringing the inventories to their present location and condition. |

What is the basis of charging inventories to expenses?

|

The period in which the inventories are sold, and revenue is recognized, the carrying amount of those inventories are charged to expense during the same period. If inventories are recognized on NRV then the difference between carrying value and NRV needs to be written down as expense in the period in which the write down or loss takes place. |

What are the cost elements not included in valuing inventories?

|

The cost elements not included in valuing inventories: Abnormal wastage Storage costs unless it is part of production process Administration overhead Selling and Distribution overhead |

How are borrowing costs treated in valuing inventories?

IAS 23, Borrowing Costs, identifies limited circumstances where borrowing costs are included in the cost of inventories.

How are inventories valued in cases of deferred settlement?

| When the inventories are purchased at deferred settlement terms and the arrangement effectively contains a financing element, that element, for example a difference between the purchase price for normal credit terms and the amount paid, is recognised as interest expense over the period of the financing. |

How are inventories related to service providers are valued?

|

Inventories related to service providers are valued at the costs of their production. These costs consist primarily of the labour and other costs of personnel directly engaged in providing the service, including supervisory personnel, and attributable overheads. |

How do we define Cash?

Cash comprises cash on hand and demand deposits.

What are Cash equivalents?

Cash equivalents are short‑term, highly liquid investments that are readily convertible to known amounts of cash and which are subject to an insignificant risk of changes in value.

What is meant by Cash flow?

Cash flows are inflows and outflows of cash and cash equivalents.

What are the classifications of cash flow statement?

The classifications of cash flow statement are:

∙ Operating activities

∙ Investing activities

∙ Financing activities

What are operating activities?

|

Activities that are the principal revenue‑producing activities of the entity and other activities that are not investing or financing activities. |

What are financing activities?

|

Activities which result in changes in size and composition of the borrowings and equity of the entity (e.g., cash proceeds from issuing shares, cash proceeds from issuing debt instruments, cash payments to repay amount borrowed) |

What are investing activities?

|

activities representing acquisition and disposal of long-term assets and other investments (not including cash equivalents) (e.g. cash receipts and payments to acquire and dispose of property, plant and equipment, cash receipts and payments to acquired and dispose of equity and debt investments including subsidiaries and other business units) |

What is direct method of cash flow statement?

|

Major classes of gross cash receipts and payments are disclosed (sales, cost of sales, purchases, employee benefits etc |

What is indirect method of cash flow statement?

Profit or loss of the period is adjusted for non-cash items and items of income or expenses related to investing and financing activities

What is the treatment of interest paid in cash flow statement?

In case of other than financial entities, IAS 7 gives an option to classify the interest paid and interest and dividends received as item of operating cash flows.

What is the treatment of dividend paid and received in cash flow statement?

IAS 7 gives an option to classify the dividend paid as an item of operating activity.

What are accounting policies?

|

Accounting policies are specific principles, bases, conventions rules and practices applied by an entity in preparing and presenting Financial Statements. |

When an accounting policy can be changed?

|

An accounting policy can be changed only if the change: is required by standard or interpretation, or results in financial statements providing reliable and more relevant information about the effects of transactions, events or conditions on the entity’s financial performance or cash flows When change would be accounted for as per new pronouncement or otherwise it is applied retrospectively. However, if it is impracticable to carry out such change, then the entity shall apply the policy on the carrying amounts of assets and liabilities as at the beginning of the earliest period and make adjustments to the opening balance affected items of equity. |

What are accounting estimates?

|

The effect of change in an accounting estimate shall be recognized prospectively by including it in the profit or loss of the year of change or also in the future periods, if the change affects both: If the extent of the change impacts assets and liabilities or relates to any item of equity it is recognized by adjusting the carrying amount of the related asset, liability, or equity item. IAS 8 has provided certain disclosures to these accounting estimates which would include accounting estimates made in respect of – their nature and their carrying amount as at the end of the reporting period |

What are accounting errors?

|

The general principle is that the entity must correct all material prior period errors retrospectively as soon as they are discovered by restating the comparative amounts for the prior period(s) presented in which the error occurred or if the error occurred before the earliest prior period presented, restate the opening balances of assets, liabilities and equity for the earliest period presented. |

What are adjusting events?

|

Adjusting events are those events which provide evidence of conditions that existed within the reporting period (e.g. settlement of court case which proves obligations of the Company, bankruptcy of a customer from whom out standings are reported etc) |

What are non-adjusting events?

|

Non-adjusting events are those events with respect to which the Financial statements need not be adjusted but need to be disclosed by the approving authority. |

Is proposed dividend an adjusting event?

|

If an entity declares dividends to holders of equity instruments (as defined in IAS 32 Financial Instruments: Presentation) after the reporting period, the entity shall not recognize those dividends as a liability at the end of the reporting period. |

What is current tax?

|

Current Tax is the amount of income taxes payable (recoverable)in respect of the taxable profit (tax loss) for a period. |

What is deferred tax liabilities?

|

Deferred tax liabilities are the amount of income taxes payable in future periods in respect of taxable temporary differences. IAS 12 mandates the entity to recognize deferred tax liability in full. |

What is deferred tax assets?

|

Deferred tax assets are the amounts of income taxes recoverable in future periods in respect of: (a) deductible temporary differences. (b) the carry forward of unused tax losses; and (c) the carry forward of unused tax credits. |

What is called tax base?

|

The tax base of an asset or liability is the amount attributed to that asset or liability for tax purposes. |

What is taxable temporary difference?

|

Taxable temporary differences are temporary differences that will result in taxable amounts in determining taxable profit (tax loss) of future periods when the carrying amount of the asset or liability is recovered or settled. |

What is deductible temporary difference?

|

Deductible temporary differences, which are temporary differences that will result in amounts that are deductible in determining taxable profit (tax loss) of future periods when the carrying amount of the asset or liability is recovered or settled. |

How are non-current assets defined in IAS 16?

|

Current Assets are defined as under: It is expected to be realized in, or is intended for sale or consumption in, the entity’s normal operating cycle, It is held primarily for the purpose of being traded, It is expected to be realized within 12 months after the statement of financial position date, or It is cash or a cash equivalent (as defined in IAS 7 Statement of Cash Flow) unless it is restricted from being exchanged or used to settle a liability for at least twelve months after the statement of financial position date. All other assets are classified as non-current assets. |

What are Property, Plant & Equipment?

|

Property, Plant & Equipment are tangible items that: (a) are held for use in the production or supply of goods or services, for rental to others, or for administrative purposes; and (b) are expected to be used during more than one period. |

What is a Bearer Plant?

|

A Bearer Plant is a living plant that, (a) is used in the production or supply of agricultural produce, (b) is expected to bear produce for more than one period: and (c) has a remote likelihood of being sold as agricultural produce, except for incidental scrap sales. |

What is meant by Carrying amount?

|

Carrying amount is the amount at which an asset is recognised after deducting any accumulated depreciation and accumulated impairment losses. |

What is meant by Cost?

|

Cost is the amount of cash or cash equivalents paid or the fair value of the other consideration given to acquire an asset at the time of its acquisition or construction or, where applicable, the amount attributed to that asset when initially recognised in accordance with the specific requirements of other IASs e.g. IAS 102 Share-based Payment. |

What is meant by Depreciable amount

Depreciable amount is the cost of an asset, or other amount substituted for cost, less its residual value.

What is Entity-specific value?

Entity-specific-value is the present value of the cash flows an entity expects to arise from the continuing use of an asset and from its disposal at the end of its useful life or expects to incur when settling a liability

What is meant by Fair value?

Fair value is the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. (See IFRS 13, Fair Value Measurement.)

What is an impairment loss?

Impairment loss is the amount by which the carrying amount of an asset exceeds its recoverable amount.

What is Recoverable amount?

is the higher of an asset’s fair value less costs of disposal and its value in use.

What is meant by the residual value of an asset?

is the estimated amount that an entity would currently obtain from disposal of the asset, after deducting the estimated costs of disposal, if the asset were already of the age and in the condition expected at the end of its useful life

What is Useful life?

(a) the period over which an asset is expected to be available for use by an entity; or

(b) the number of production or similar units expected to be obtained from the asset by an entity.

How are Property, Plant & Equipment recognized and measured initially

Property, Plant, and equipment is initially recognized and measured at historical cost.

What are the elements of measurement of initial cost?

Purchase price

Considered after deducting trade discounts and rebates and adding duties and non-refundable taxes

The price to be considered is the cash price equivalent at the recognition date. If the asset is acquired on deferred credit i.e. credit beyond the normal credit period, then the difference between the cash price and the total payment is treated as interest and recognised over the credit period

The cost of assets involved in the exchange is determined at fair value (of asset received or the asset given up) unless:

a) the transaction lacks commercial substance; or

b) the fair value of neither of the two assets is reliably measured

In such a scenario the cost of the asset acquired is measured at the carrying amount of the asset given up.

Costs directly attributable to bringing the asset to its location and in the condition so as to make it available for its intended use

a) Costs of employee benefits (as per IAS 19R Employee benefits), arising from construction or acquisition of property, plant, and equipment

b) Costs of preparing the site

c) Delivery and handling costs (freight and delivery charge)

d) Installation costs (e.g. wages to install machinery)

e) Testing costs net of revenue generated, such as sale proceeds of material produced during a test run

f) Professional fees (architect’s fees)

The initial estimate of the costs of dismantling and removing the item and restoration of site Either:

a) When the item is acquired or

b) As a consequence of having used the item during a particular period for purposes other than to produce inventories during that period.

The obligation for paying dismantling///restoration cost would arise at the time of capitalization of the asset, but actual pay-out happens after a designated number of years when the asset is restored and handed over, say land taken for mining for example.

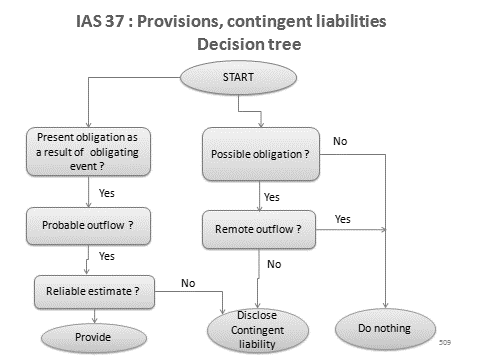

Hence the present value of restoration cost needs to be calculated and for capitalization purposes. However, liability of paying out restoration cost is established in the financial statements by unwinding of discount and providing finance charges every year and crediting provision for restoration///dismantling. For further details please refer Chapter on IAS 37, Provisions, contingent liabilities, and contingent assets.

What are the elements of cost which are not part of Property, Plant and Equipment?

a) Administration and general overhead

b) Cost of launching a new product or service

c) Expenses on opening a new business facility or expenses related to an inaugural function

d) Cost of relocating – shifting factory consequent to statutory order

e) Initial losses when the asset operates at lower capacity

f) Costs of incidental operations not necessary to bring the asset to its required condition and location.

How are Property, Plant & Equipment recognized and measured subsequently?

Subsequently, these are measured

Under cost model, wherein, they are carried at cost less accumulated depreciation and any accumulated impairment loss or

Under revaluation model, wherein the revalued amount less subsequent accumulated depreciation and any accumulated impairment loss

Revaluation amount is the fair value at date of valuation.

What is the accounting treatment where the carrying amount of asset has increased under revaluation model?

If an asset’s carrying amount is increased – it should be recognised in other comprehensive income and accumulated in equity under the heading revaluation surplus.

However, if there is a revaluation decrease of the same asset earlier – which was recognised in SOPL as per IAS 16 –then the increase should be credited in SOPL to the extent it reverses the revaluation decrease.

What is the accounting treatment where the carrying amount of asset has decreased under revaluation model?

If an asset’s carrying amount is decreased – it should be recognised in statement of profit or loss (income statement). However, if there is a balance in the revaluation surplus under equity for the same asset based on revaluation performed earlier, such decrease is recognised in other comprehensive income.

What is the treatment of revaluation surplus and profit or loss on sale?

When the assets are derecognized (sold), the revaluation surplus included in equity should be transferred directly to retained earnings. Profit or loss on sale will be calculated in the usual manner i.e. sale proceeds less carrying value (revalued)

What are the depreciation methods highlighted in the Standard?

The depreciation methods highlighted in the Standard are:

- The straight-line method: This result is a constant change over the useful life if the asset’s residual value does not change

- The reducing (diminishing) balance method: This results in decreasing change over the useful life

- The units of production method: This results in a change based on expected use or output

- As per IAS 16 Para 43, each part of an item of property, plant and equipment with a cost that is significant in relation with the total cost of the item should be depreciated separately.

Insignificant parts are depreciated together

What is meant by componentization of depreciation?

As per IAS 16 Para 43, each part of an item of property, plant and equipment with a cost that is significant in relation with the total cost of the item should be depreciated separately.

How is depreciation calculated after revaluation?

Depreciation will be based on revalued amount

- Full depreciation amount charged as expense to Statement of profit or loss

- Difference between depreciation on revalued amount & original cost may be transferred from revaluation reserve to retained earnings. This is further explained in the table below.

|

Asset |

Treatment |

|

Sold/no longer used |

Revaluation surplus transferred to retained earnings. |

|

Still in use |

A part of the revaluation surplus can be transferred to retained earnings. It is equal to difference between depreciation based on historical cost and its revalued amount |

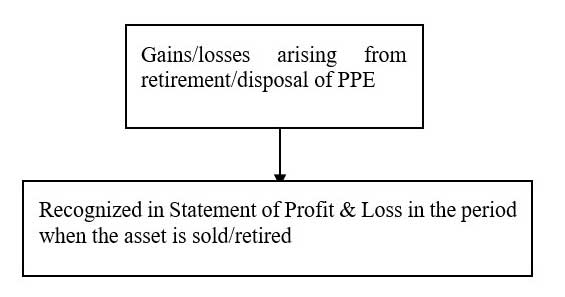

How is de-recognition of Plant, Property and Equipment treated?

PPE is derecognized (eliminated) from Balance Sheet when PPE is disposed of or withdrawn from use & no future economic benefits expected from its disposal.

What are the disclosure requirements under Property, Plant & Equipment?

The financial statements shall disclose, for each class of property, plant, and equipment:

(a) the measurement bases used for determining the gross carrying amount.

(b) the depreciation methods used.

(c) the useful lives or the depreciation rates used;

(d) the gross carrying amount and the accumulated depreciation (aggregated with accumulated impairment losses) at the beginning and end of the period; and

(e) a reconciliation of the carrying amount at the beginning and end of the period:

(i) additions.

(ii) assets classified as held for sale or included in a disposal group classified as held for sale in accordance with IFRS 5 and other disposals;

(iii) acquisitions through business combinations; increases or decreases resulting from revaluations under paragraphs 31, 39 and 40 and from impairment losses recognised or reversed in other comprehensive income in accordance with IAS 36;

(iv) impairment losses recognised in profit or loss in accordance with IAS 36;

(v) impairment losses reversed in profit or loss in accordance with IAS 36;

(vi) depreciation;

(vii) the net exchange differences arising on the translation of the Financial statements from the functional currency into a different presentation currency, including the translation of a foreign operation into the presentation currency of the reporting entity; and

(viii) other changes.

The financial statements shall also disclose:

(a) the existence and amounts of restrictions on title, and property, plant and equipment pledged as security for liabilities.

(b) the amount of expenditures recognised in the carrying amount of an item of property, plant and equipment in the course of its construction.

(c) the amount of contractual commitments for the acquisition of property, plant and equipment; and

(d) if it is not disclosed separately in the statement of profit and loss, the amount of compensation from third parties for items of property, plant and equipment that were impaired, lost or given up that is included in profit or loss.

If items of property, plant and equipment are stated at revalued amounts, the following shall be disclosed:

(a) the effective date of the revaluation.

(b) whether an independent valuer was involved;

(c) the methods and significant assumptions applied in estimating the items’ fair values.

(d) the extent to which the items’ fair values were determined directly by reference to observable prices in an active market or recent market transactions on arm’s length terms or were estimated using other valuation techniques.

(e) for each revalued class of property, plant and equipment, the carrying amount that would have been recognised had the assets been carried under the cost model; and

(f) the revaluation surplus, indicating the change for the period and any restrictions on the distribution of the balance to shareholders.

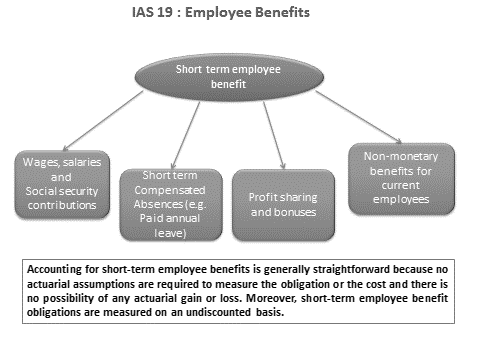

What are the types of employee benefits?

Employee benefits are all forms of considerations given by an entity in exchange of service rendered by the employees.

These are:

- Short term benefits,

- Post-employment benefits,

- Other long-term benefits,

- Termination benefits.

What are short term benefits?

Short term benefits

- Falling due within 12 months of rendering service (e.g. salaries, Bonuses, holiday pay, sick pay).

- Recognized as expenses in the period of rendering of services of the employee to the entity.

- The expected cost of compensated absences is recognized when

– the absences occur for non-accumulating compensated absences and

– the service is rendered increasing the employee’s entitlement to benefits for accumulating compensated absence

- Profit sharing and bonus payments are recognized when the entity has a present legal or constructive obligation as a result of past events and a reliable estimate can be made of the obligation.

- Liability is recognized for unpaid short-term benefits

What are post employment benefits?

Post-employment benefits

- Payable after completion of employment (e.g. pension, life insurance, medical care etc)

- Classified into either

a) defined contribution plans or

b) defined benefit plans

What are defined contribution plans?

These are plans where an employer pays fixed contributions to a separate entity and will have no legal or constructive obligations to pay further contributions if the fund does not hold sufficient assets to pay all employee benefits relating to employee service in the current and prior periods. Contribution to defined contribution plan to be recognized as expense as the employee renders services to the entity.

What are defined benefit plans?

These are plans where size of post-employment benefits is determined in advance. The employer pays contributions to the plan and the contributions are invested. The size of the contribution is set at an amount that is expected to earn enough investment returns to meet the obligation to pay the post – employment benefits.

What is projected unit credit method under defined benefit plan?

Projected unit credit method assumes that each period of service by an employee would give rise to an additional unit of future benefits. The present value of that unit of future benefits can be calculated and attributed to the period in which the service is given. The units, each measured separately, builds up to the overall obligation.

The accumulated present value of (discounted) future benefits will incur interest over time and an interest expense should be recognized.

What are past service costs as defined by IAS 19?

Past service cost is the change in the present value of the defined benefit obligation for employee service in prior periods, resulting from a plan amendment (the introduction or withdrawal of, or changes to, a defined benefit plan) or a curtailment (a significant reduction by the entity in the number of employees covered by a plan). IAS 19 Para 8

What are re-measurements of net defined liability (asset)?

Re-measurements of net defined liability (asset) comprise:

a) Actuarial gains and losses on the defined benefit obligation

b) Return on plan assets, excluding amounts included in net interest on the defined benefits liability (asset)

c) Any change in the effect of the asset ceiling, excluding amounts included in net interest on the net defined benefit liability (asset).

What is asset ceiling?

Asset ceiling is the present value of any economic benefits available in the form of refunds from the plan or reductions in future contributions to the plan

What is the Net defined benefit liability / (asset) and its treatment in SOFP?

The net defined benefit liability (asset) includes:

a) The present value of defined benefit obligation

b) Less, fair value of any plan assets (including the deficit or surplus in a defined benefit plan) adjusted for

c) Any effect of limiting net defined benefit asset to the asset ceiling

Net defined benefit liability / (asset) and its treatment in SOPL?

IAS 19 R requires that entities should recognize all changes in the net defined benefit liability (asset) in the period in which those changes occur, and to disaggregate and recognize defined benefit cost as under:

Service cost – SOPL

Net interest on the net defined benefit liability (asset) – SOPL

Re-measurements – OCI

What are other long-term benefits?

Other long-term benefits

These are not payable within 12 months (long service leave etc)

– An entity recognizes a liability for other long-term benefits equal to the present value of the defined benefit obligation, minus the fair value of any plan assets at the balance sheet date.

– Recognize immediately any actuarial gains or losses or past service costs as income or expense.

What are termination benefits?

Termination benefits are payable when an employee’s contract is terminated either voluntarily or involuntarily (e.g. voluntary retirement, redundancy pay)

– An entity recognizes the liability and an expense for termination benefits when it is explicitly committed to either

a) provide termination benefits as a result of an offer made in order to encourage voluntary redundancy or

b) terminate the employment of employees before the normal retirement date

IAS 19 provides certain disclosures on employee benefits.

What are multi-employer plans?

Multi-employer plans are defined contribution plans (other than state plans) or defined benefit plans (other than state plans) that:

(a) pool the assets contributed by various entities that are not under common control; and

(b) use those assets to provide benefits to employees of more than one entity, on the basis that contribution and benefit levels are determined without regard to the identity of the entity that employs the employees concerned.

What are plan assets comprised of?

Plan assets comprise:

(a) assets held by a long-term employee benefit fund; and

(b) qualifying insurance policies.

What is meant by Fair value under IAS 19(R)

Fair value is the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. (See IFRS 13 Fair Value Measurement.)

What are assets held by a long-term employee benefit fund?

Assets held by a long-term employee benefit fund are assets (other than non-transferable financial instruments issued by the reporting entity) that:

(a) are held by an entity (a fund) that is legally separate from the reporting entity and exists solely to pay or fund employee benefits; and

(b) are available to be used only to pay or fund employee benefits, are not available to the reporting entity’s own creditors (even in bankruptcy), and cannot be returned to the reporting entity, unless either:

(i) the remaining assets of the fund are sufficient to meet all the related employee benefit obligations of the plan or the reporting entity; or

(ii) the assets are returned to the reporting entity to reimburse it for employee benefits already paid.

What is a qualifying insurance policy?

A qualifying insurance policy

is an insurance policy issued by an insurer that is not a related party (as defined in IAS 24 Related Party Disclosures) of the reporting entity, if the proceeds of the policy:

(a) can be used only to pay or fund employee benefits under a defined benefit plan; and

(b) are not available to the reporting entity’s own creditors (even in bankruptcy) and cannot be paid to the reporting entity, unless either:

(i) the proceeds represent surplus assets that are not needed for the policy to meet all the related employee benefit obligations; or

(ii) the proceeds are returned to the reporting entity to reimburse it for employee

benefits already paid

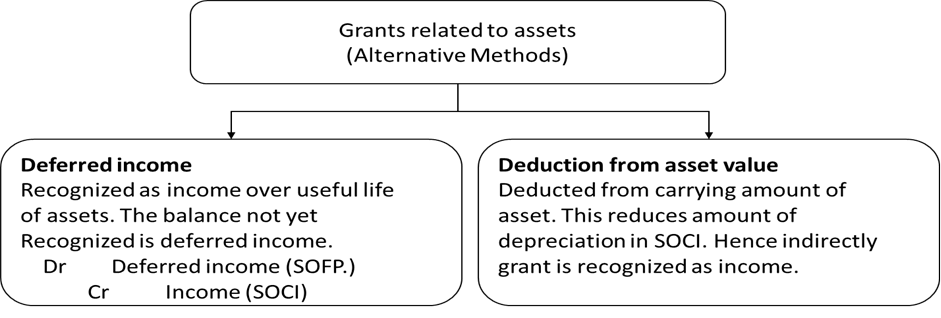

What are the types of Government grants?

A Government grant is recognized only when enterprise will comply with any conditions attached to it.

Government grants are of two types-

a) Grant related to income

b) Grant related to assets

How is a grant related to income treated?

A grant related to income may be reported as other income or deducted from related expense.

How is a grant related to assets treated?

Recognition of Government grants is based on two alternative methods. These are shown below in the flow diagram.

What are the principles of repayment of grant?

Accounting treatment related to repayment of grant depends upon how the grant was disclosed initially when it was received

- carrying value of the asset is increased (if original receipt of grant was reduced from carrying value) or

- the deferred income balance is reduced by the amount payable (if original receipt of grant was treated as deferred income).

What are the disclosure requirements under Government grant?

The following matters shall be disclosed:

a) The accounting policy adopted for government grants, including the methods of presentation adopted in the financial statements

b) The nature and extent of government grants recognised in the financial statements and an indication of other forms of government assistance from which the entity has directly benefited and

c) Unfulfilled conditions and other contingencies attaching to government assistance that has been recognised.

How is a foreign currency transaction recorded initially?

A foreign currency transaction is recorded initially in functional currency by applying the foreign currency amount, the spot exchange rate between the functional currency and the foreign currency at the date of the transaction. For practical reasons average weekly or monthly rate is used which is closest to the actual rate at the transaction date.

How are foreign currency transactions translated subsequently?

Regarding all statement of financial position related transactions:

- Foreign currency monetary items are translated using the closing rate

- Non-monetary items that are measured in terms of historical costs in a foreign currency are translated using exchange rate at the date of the transaction – using approximate or average rate as may be applicable and

- non-monetary items are measured at fair value in a foreign currency and are translated using the exchange rate at the date when the fair value was determined.

Regarding all transactions related to income statement, items may be translated using an average rate.

How are exchange differences treated with respect to monetary items?

On settlement of monetary items or on translating monetary items at rates different from those at initial recognition are recognized in profit or loss.

Exchange differences arising on a monetary item that forms part of an entity’s net investment in foreign operations are recognized as a separate component of equity in the financial statements that include the foreign operation and the reporting entity.

Such exchange differences are recognized in profit or loss on disposal of net investment.

How are exchange differences treated with respect to non- monetary items?

When a gain or loss on a non-monetary item is recognised in other comprehensive income, any exchange component of that gain or loss shall be recognised in other comprehensive income.

Conversely, when a gain or loss on a non-monetary item is recognised in profit or loss, any exchange component of that gain or loss shall be recognised in profit or loss.

What are the disclosure requirements related to foreign currency transactions?

An entity shall disclose:

- The amount of exchange differences recognised in profit or loss except for those arising on financial instruments measured at fair value through profit or loss in accordance with IFRS 9.

- Net exchange differences recognised in other comprehensive income and accumulated in a separate component of equity, and a reconciliation of the amount of such exchange differences at the beginning and end of the period; and

- Net exchange differences recognised directly in equity and accumulated in a separate component of equity, and a reconciliation of the amount of such exchange differences at the beginning and end of the period.

What are borrowing costs?

Borrowing costs are interest and other costs incurred by an enterprise in connection with the borrowing of funds. These costs include the following:

– interest on bank overdrafts and borrowings

– finance charges on finance leases

– exchange difference on foreign currency borrowings as adjustment to interest Costs

What are qualifying assets?

Qualifying asset is an asset that takes substantial period of time to get ready for its intended use. It can be property, plant, equipment and investment property during construction period, intangible assets during development period or made-to-order inventories.

When are borrowing costs capitalized?

Borrowing costs that are directly attributable to the acquisition, construction, or production of a qualifying asset should be capitalized as part of the cost of that asset.

To the extent that funds are borrowed specifically for the purpose of obtaining a qualifying asset, the amount of borrowing costs eligible for capitalization on that asset should be determined as the actual borrowing costs incurred on that borrowing during the period less any income on the temporary investment of those borrowings.

Other borrowing costs should be recognised as an expense in the period in which they are incurred.

What is capitalization rate?

The capitalization rate should be the weighted average of the borrowing costs applicable to the borrowings of the enterprise that are outstanding during the period, other than borrowings made specifically for the purpose of obtaining a qualifying asset.

When should capitalization of borrowing costs commence?

Capitalization of borrowing costs commences when:

(a) expenditure for the acquisition, construction or production of a qualifying asset is being incurred.

(b) borrowing costs are being incurred; and

(c) activities that are necessary to prepare the asset for its intended use or sale are in progress.

When should capitalization of borrowing costs cease?

Capitalization of borrowing costs should cease when substantially all the activities necessary to prepare the qualifying asset for its intended use or sale are complete.

What are the disclosure requirements under capitalization of borrowing cost?

An entity shall disclose,

a) the amount of borrowing costs capitalized during the period, and

b) the capitalization rate used to determine the amount of borrowing costs eligible for capitalization.

Who is a related party?

A related party is a person or an entity that is related to the entity that is preparing its financial statements (reporting entity) as under:

a) A person or a close member of that person’s family is related to a reporting entity

– if he has control or joint control over the reporting entity

– has significant influence over the reporting entity or

– is a member of key management personnel of the reporting entity or of a parent of the reporting entity

b) An entity is related to a reporting entity if :

– entity and reporting entity are members of the same group (i.e. each parent, subsidiary, or fellow subsidiary is related to the other)

– one entity is an associate or joint venture of the other entity or associate or joint venture of a member of a group of which the other entity is a member

– both entities are joint ventures of the same third party

– one entity is a joint venture of the third party and the other entity is an associate of the third entity

– the entity is a post-employment defined benefit plan for the benefit of the employees of the reporting entity or an entity related to the reporting entity.

If reporting entity is itself such a plan, then sponsoring employers are also related to the reporting entity

– the entity is controlled or jointly controlled by a person in (a) above

– a person identified in a above has significant influence over the entity or is a member of the key management of the entity or its parent

Which are the entities which are not deemed to be related?

two entities simply because they have a common director or manager

- two venturers who share a joint control over a joint venture

- providers of finance, trade unions, public utilities, and departments and agencies of a Govt that does not control, jointly control, or significantly influence the reporting entity simply by virtue of normal dealings with an entity

- a single customer. Vendor, franchiser, distributor, or general agent with whom an entity transacts a significant volume of business merely by virtue of resulting economic dependence

What are related party transactions?

Transfer of resources, services, or obligations between related parties regardless whether a price is charged; this transfer of resources includes transactions concluded on an arm’s length basis. The following are examples of these transactions:

- Purchase or sale of goods

- Purchase or sale of property or other assets

- Rendering or receipt of services

- Agency arrangements

- Lease agreements

- Transfer of research and development

- License agreements

- Finance, including loans and equity contributions

- Guarantees and collaterals

- Management contracts

How are related party transactions disclosed?

An entity must disclose its parent and ultimate controlling entity if applicable.

If neither the parent nor ultimate controlling entity produces a financial statement for public use, then the next most senior parent that does so need to be disclosed

What is basic earnings per share?

Basic earnings per share is calculated by dividing profit or loss attributable to ordinary equity holders of the parent entity (the numerator) by the weighted average number of ordinary shares outstanding (denominator) during the period.

What is a bonus issue?

A bonus issue entails capitalizing the profits of the entity and issuing shares to the existing shareholders without receiving any resources in return. In short it is only a book entry.

What is a right issue?

A rights issue is primarily when a company offers exiting shareholders a right to purchase additional shares on the company at a given price, which is at a discount to the prevailing market price of the shares.

How are diluted earnings per share calculated?

Diluted earnings per share is calculated by adjusting profit or loss attributable to ordinary equity holders of the parent entity and the weighted average number of ordinary shares outstanding for the effects of all dilutive potential ordinary shares.

When earnings per share should be restated?

Earnings per share should be restated, if the number of shares outstanding is affected as a result of capitalization, bonus issue, share split or a reverse share split, the calculation of basic EPS and diluted EPS should be adjusted retrospectively.

What are the disclosure requirements related to Earnings per share?

According to para 70 of IAS 33 an entity shall disclose the following:

a) The amounts used as the numerators in calculating basic and diluted earnings per share and a reconciliation of those amounts to profit or loss attributable to the parent entity of the period. The reconciliation shall include the individual effect of each class of instruments that affects earnings per share.

b) The weighted average number of ordinary shares used as the denominator in calculating basic and diluted earnings per share, and a reconciliation of these denominators to each other. The reconciliation shall include the individual effect of each class of instruments that affects earnings per share.

c) Instruments (including contingently issuable shares) that could potentially dilute basic earnings per share in the future, but were not included in the calculation of diluted earnings per share because they are anti dilutive for the periods presented

d) A description of ordinary share transactions or potential ordinary share transactions, other than those accounted for under retrospective adjustments, that occur after the reporting period and that would have changed ordinary shares outstanding at the end of the period if those transactions had occurred before the end of the reporting period.

How is interim financial reporting defined?

Interim financial reporting is signified as the minimum content of an interim financial report as a condensed statement of financial position, condensed income statement, condensed income statement showing changes in equity, condensed cash flows statement and selected explanatory notes.

What would an interim financial report include?

An interim financial report shall include, at a minimum, the following:

a) a condensed statement of financial position (including condensed statement of changes in equity for the period which is presented as a part of the balance sheet)

b) a condensed statement of profit and loss

c) a condensed statement of cash flows and selected explanatory notes

What are the accounting policies to be adhered to in interim financial reporting?

For internal financial reporting, same accounting policies are required to be adhered to as applicable to annual financial statements

except accounting policy changes made after the most recent annual financial statements have been published

Frequency of entity’s report should not affect the measurement of its annual results.

Measurement of interim reporting should be made on Year-to-Date basis

How is deferral of revenues treated under interim financial reporting?

IAS 34 requires that such revenues are recognized when they occur because anticipation or deferral would not be appropriate at the statement of financial position date.

How is deferral of expenses treated under interim financial reporting?

Expenses that are incurred unevenly during an entity’s financial year should be anticipated or deferred for interim reporting purposes, if and only if , it is also appropriate to anticipate or defer that type of cost at the end of the financial year.

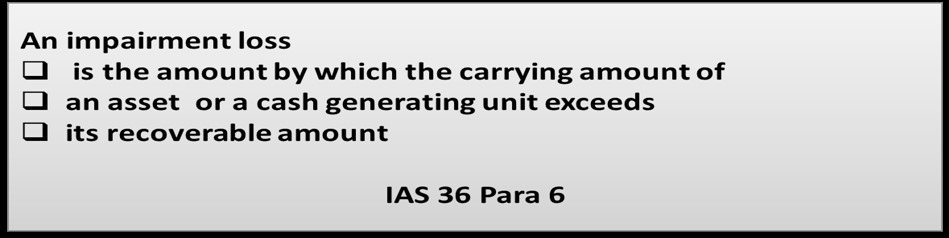

What is impairment of assets

Impairment of assets relates to procedures that an entity applies to ensure that its assets are carried at no more than their recoverable amount.

What is a recoverable amount?

Recoverable amount is the higher of an asset’s fair value less cost of disposal and its value in use.

What is value in use?

Value in use is the present value of estimated future cash flows expected to arise from the continuing use of an asset and from its disposal at the end of its useful life

What is fair value less cost of disposal?

is the amount obtainable from the sale of an asset in an arm’s length transaction between knowledgeable, willing parties, less the costs of disposal.

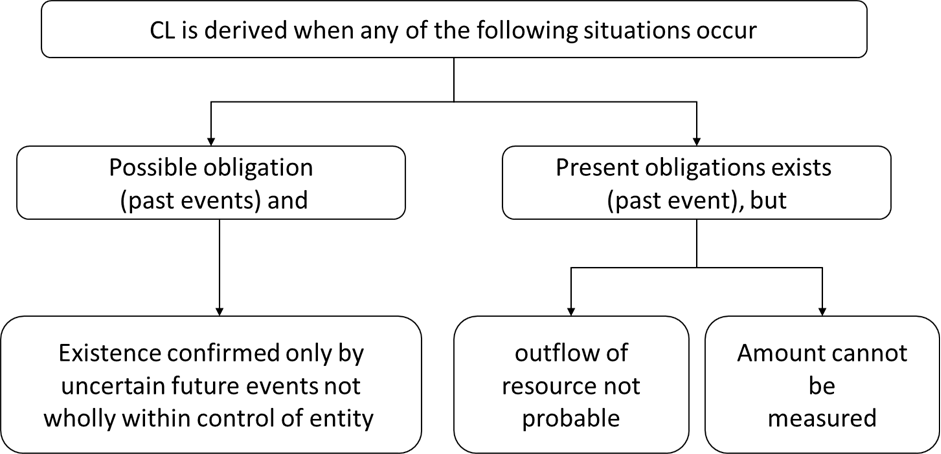

What is impairment loss?

Impairment loss is the amount by which the carrying amount of an asset exceeds its recoverable amount.

How is fair value less cost of disposal measured?

The best evidence of an asset’s fair value less cost to sell is a price which is binding sale agreement in an arm’s length transaction, adjusted for incremental costs that would be directly attributable to the disposal of the asset.

If there is no binding sale agreement but an asset is traded in an active market, net selling price is the asset’s market price less the costs of disposal. The appropriate market price is usually the current bid price.

Depreciation (Amortisation)

Depreciation is a systematic allocation of the depreciable amount of an asset over its useful life.

What is a cash generating unit?

Cash generating unit is the smallest identifiable group of assets that generates cash inflows from continuing use that are largely independent of the cash inflows from other assets or groups of assets.

What are Corporate assets?

Corporate assets are assets other than goodwill that contribute to the future cash flows of both the cash generating unit under review and other cash generating units.

What is an active market?

An active market is a market where all the following conditions exist:

(a) the items traded within the market are homogeneous;

(b) willing buyers and sellers can normally be found at any time;

(c) prices are available to the public.

What is the treatment of goodwill for the purpose of impairment testing in a Cash Generating Unit?